The story of the Dow Jones crash in 1929 and its parallels with the present day

When we hear the phrase “stock market crash,” images immediately come to mind—red candles on charts, noisy exchanges, panicking traders. But it was the crisis of 1929 that was the first wave that turned a normal correction into a prolonged crash and a decade-long economic depression. It was not just a stock market event — it changed the very approach to investing.

At first glance, the United States in the late 1920s was a model of economic miracle: industrial growth, urbanization, and record highs on the stock market. The Dow Jones rose at breakneck speed, and stocks became the object of mass fascination. Even those who had been selling newspapers yesterday were now heading to Wall Street to buy “securities of the future.” But behind the facade of universal optimism, there was a festering sore. There were no real grounds for the market euphoria: company valuations were inflated, credit was readily available, and regulators were passive. In October 1929, the bubble burst. Why did the stock market crash? The answer is more complicated than it seems — and, unfortunately, still relevant today.

What caused the US stock market crash of 1929: the accumulation of risks and illusions

From 1924 to 1929, the Dow Jones index grew almost fourfold. People invested in stocks without understanding the essence of the business. Trading was conducted with borrowed funds, using a margin lending scheme. The media and analysts fueled the hype. The idea that the market could only grow became a new religion.

But there were no fundamentals behind this growth. Company profits could not keep pace with valuations. Speculative activity drove out investment. And when the first signs of instability appeared, the market collapsed.

Black October: how everything collapsed in a matter of days

On October 24, 1929, known as Black Thursday, panic set in: sales volumes reached a record 12 million shares. The stock exchange couldn’t cope, teletypes lagged behind, and brokers lost contact with their clients.

On October 28, Black Monday, the Dow fell 13%. And on October 29, Black Tuesday, it fell another 12%. In two days, the market lost almost 25%. The volume of transactions reached 16 million, unthinkable for that era.

Real-life examples of the collapse:

- U.S. Steel: from ~$262 to $22

- General Electric: -85% from its peak

- RCA (owner of NBC): from $505 to $26

Panic spread to the economy. Banks called in loans, margin accounts were wiped out. People lost absolutely everything, from capital to housing. Stock market losses exceeded $30 billion. America entered the Great Depression.

Why did the stock market crash in 1929? Because investors believed that constant growth was the new normal. And a financial market without balance is not a market, but an illusion.Today, we live in an era where access to data, trade automation, and regulation have become much more sophisticated. But the emotional traps remain the same. Everything that happened in 1929 could happen again, in a new package and with new names.

The conclusion? Learn from history. Invest with analysis, not guesswork, and don’t follow media personalities. Diversify, watch the fundamentals, and don’t be afraid of corrections — be afraid of euphoria. Trading stocks on the stock market is not a casino, but a tool for growth. But only in skilled hands, with competent analysis and confident actions.

Lessons for investors from Black Tuesday

The crash of 1929 is not just history, it is a survival guide for investors. Here’s what’s important to remember:

- Don’t invest with borrowed money.

Margin trading amplifies both profits and losses. When the market crashes, you risk being wiped out in seconds. - Hype is the enemy of common sense.

If the price is not backed by profits, it’s a bubble. In the 1920s, it was “trendy” industrial stocks; in the 2020s, it’s SPACs, NFTs, and cryptocurrencies. - Diversify. Always.

Don’t put all your eggs in one basket or sector. A balance between stocks, bonds, real estate, and even cash saves your portfolio. - Panic kills capital.

Selling at the bottom locks in losses. People who held their positions after 1929 eventually recovered their losses. - The media is not a guaranteed investment advisor.

The real information is in company reports, not in headlines. - Psychology matters more than strategy.

Investors who can handle stress keep their money. Emotions are the main enemy of an investment portfolio. - Bubbles repeat themselves in the stock market. Only the masks are new.

SPACs, crypto, metaverses, AI. It’s all reminiscent of 1929, only in digital form.

Modern bubbles: cannabis, SPACs, cryptocurrencies — and more

The mistakes of the past are repeating themselves in the present:

- SPAC: Nikola and Clover Health promised a revolution but collapsed by 70-90%.

- Cryptocurrencies: Bitcoin, Terra, FTX rose on expectations and crashed on reality.

- Cannabis: Tilray, Aurora, Canopy Growth went from the hype of legalization to a fall due to regulation.

- EdTech: Chegg, Coursera, Duolingo saw a rollback and decline in capitalization after the pandemic boom.

- Stay-at-home stocks: Zoom, Peloton, DocuSign lost up to 90% after restrictions were lifted.

- NFTs and metaverses: Projects such as Decentraland collapsed to almost zero. Meta spent billions but failed to regain its audience.

Tech giants and artificial intelligence: growth or overvaluation?

Today, the spotlight is on Tesla, Nvidia, Palantir, and Alphabet. AI revolution, neural networks, autonomous transport. But is history repeating itself here, as it did in 1929?

- Tesla is an ecosystem of autonomous AI and energy, but valuations are already at their peak and competition is intensifying.

- Nvidia is benefiting from the AI boom with a trillion-dollar market cap. But how sustainable is this growth?

- Palantir is a provider of analytics for the government. The potential is great, but so far the price reflects more expectations than facts.

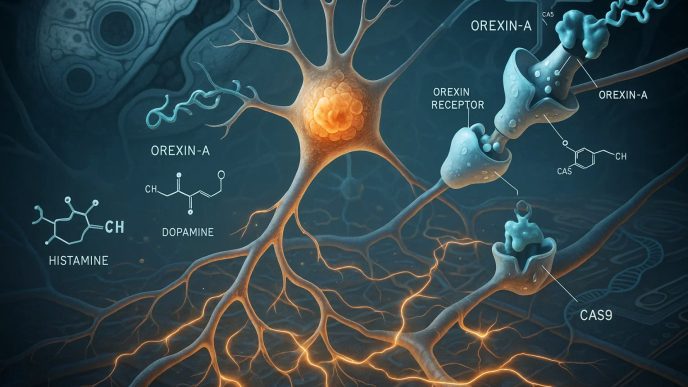

Biotechnology is one of the few sustainable trends today

Today, investors are increasingly looking for sectors that are not at the peak of a bubble, but at the stage of scientific and technological maturation. One such example is the market for genomic technologies and DNA editing, where real progress in laboratories is beginning to translate into economic value.

Companies in this field work at the intersection of biotechnology, AI, and personalized medicine, offering breakthrough solutions for the treatment of cancer, rare diseases, and developmental disorders. To gain a deeper understanding of which players are likely to set the pace for the market in the coming years, we recommend reading the analytical article:

Genome editing and company shares: who will set the pace in the market in 2025?

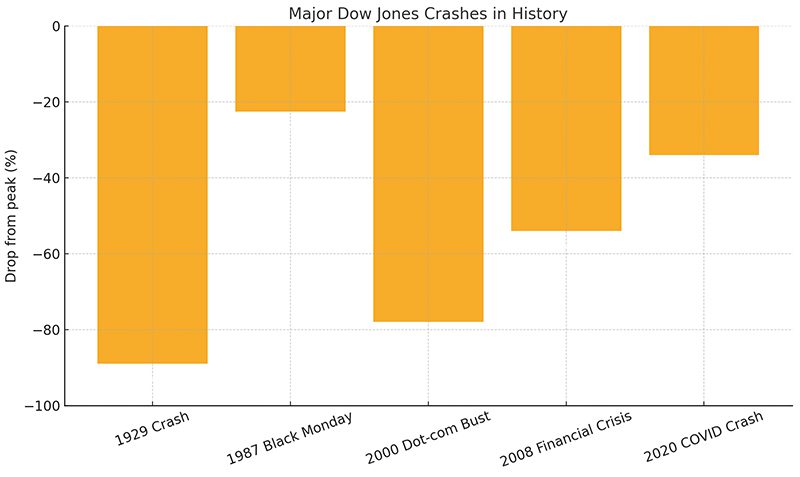

How the US market collapsed. The major crashes that Wall Street will never forget

Investors often look at charts and reports, forgetting that behind the dry figures lie emotional dramas and cold showers for billions of dollars. The US stock market knows how to soar rapidly — and how to fall painfully. Below are five periods when Wall Street was shaken by real disasters.

1929 It’s too good to be true

The fall of 1929 began with optimism. Cars, telephones, jazz, and stock speculation — America was riding a wave of prosperity. But on October 29, Black Tuesday arrived: the Dow Jones index lost tens of percent in a matter of days. Euphoria, leverage, and a lack of financial regulators were to blame. The crash led to years of depression and mass unemployment.

1987 When computers panicked

Monday, October 19. Without warning and without fundamental reasons, the market crashes — by 22.6% in a single day. The reason is a new technology: software trading. Robots began selling en masse, fueling panic. This was the first sign that technology could accelerate both growth and decline.

2000-2002: The Internet without profits

The late 1990s were a time of IPO mania: startups with websites but no revenue were valued at billions. In 2000, the bubble burst. The Nasdaq fell by almost 80%, and thousands of companies disappeared. This era taught investors to distinguish hype from a sustainable business model.

2008 The world on the brink of banking collapse

The crisis began with mortgages but quickly spread throughout the financial sector. In September, Lehman Brothers, a symbol of Wall Street, went bankrupt. Indices plummeted and confidence evaporated. The Federal Reserve and the US government launched emergency bailout programs to prevent a repeat of the Great Depression. The Dow lost more than 50% in six months.

2020 Panic in the age of the virus

COVID-19 caught the market off guard. In three weeks in March, the S&P 500 index plummeted 34%. Business came to a standstill, airlines and restaurants lost revenue, and investors sought safe havens. But the market recovered just as quickly: soft monetary policy and record stimulus measures restored interest in stocks, and a new bull cycle began.

What do all these disasters have in common?

Each crash was unexpected. Each was accompanied by panic. And each was eventually followed by growth. Investors who were able to think long-term and act calmly ultimately emerged stronger.

What the crashes of the past tell us

A stock market crash is not an anomaly, but a recurring part of the market cycle. Every crash, from the Great Depression to the COVID panic, reminds us that investing involves periods of fear and correction. The causes may vary — from credit bubbles to digital overheating — but the logic of the crash remains the same: first euphoria, then shock, then a restart.

Looking back at the Dow Jones index, it is clear that the most painful crashes turn into growth points. And that is the main lesson: a stock market crash is not scary in itself; what is scary is panic and hasty decisions. True investors are not those who always guess the right moment, but those who weather the storm and stick to their strategy. Every crash is a real test.

A falling market is a mirror. It reflects the mistakes of the past and the opportunities of the future. The main thing is not to turn away and not to act blindly. Because history shows that every fall is followed by a recovery. And the question is not whether the market will fall again, but whether you are ready for the next cycle.

If you are interested in investments at the intersection of science and finance, take a look at the biotechnology sector. New approaches to treating complex diseases such as amyotrophic lateral sclerosis (ALS) are opening up not only medical horizons but also investment opportunities. For more information, see the article: Treatment of amyotrophic lateral sclerosis and investment in biotechnology: how medical discoveries shape the stock market.