Overview of biotech stocks fighting narcolepsy: $AVDL, $AXSM, $CNTA, and others. Growth potential, demand, FDA approvals

Imagine: you are driving and suddenly lose consciousness. Or you are at a business meeting, surrounded by fluorescent lights and coffee, and suddenly you fall asleep. Narcolepsy is not just a rare diagnosis. It is a malfunction in a basic human function: the control of sleep and wakefulness. Many patients live for years without a diagnosis, attributing their symptoms to stress or fatigue. Meanwhile, this chronic disease destroys careers, personal lives, and mental health.

Paradoxically, this is what makes the field of narcolepsy treatment so promising for investors. There is a real need, growing demand, and technological breakthroughs. Medicine is waking up. And with it, the stock market.

Market potential: billions on the horizon

Narcolepsy remains an undervalued area in biotechnology investment analysis. Despite the limited number of patients, the high cost of therapy and the lifelong need for treatment make this market financially attractive. Shares in companies operating in this niche are receiving increased attention from investors.

More and more hedge funds and institutional players are including $AXSM, $HRMY, and $AVDL in their biotech portfolios. Growing demand for innovative drugs is pushing up the market capitalization of these companies. For private investors, this is a chance to buy shares at the dawn of a new medical standard.

Consumers are becoming more demanding. They want not just sleep, but a normal life. And pharmaceutical companies are beginning to offer solutions that go beyond the old stimulants.

Jazz Pharmaceuticals ($JAZZ) is a stable leader with revenue

Jazz is a veteran in the niche market of narcolepsy treatment. Its drug Xyrem was long the only treatment for excessive daytime sleepiness and cataplexy. Later, Sunosi, a daytime stimulant, appeared.

Yes, patents are expiring and pressure from generics is growing. But Jazz is not resting on its laurels: it is diversifying its portfolio, investing in R&D and continuing to generate revenue. For investors focused on moderate risk and fundamentals, $JAZZ remains an interesting stock, with a good operating margin and commercialization experience.

Avadel Pharmaceuticals ($AVDL) plays on convenience

One dose instead of two. Lumryz is a drug for narcolepsy that needs to be taken once a day. The FDA approved it in 2023. Patients are happy. Doctors are happy too.

Analysts estimate that if Lumryz captures at least 20-25% of Xyrem’s market share, AVDL’s market capitalization could grow exponentially.

For those looking for an entry point before large-scale expansion, this is an excellent candidate. There are risks, but the potential is significant. Interest from institutional funds is gradually growing.

Harmony Biosciences ($HRMY) is not addictive — and that’s the key

Wakix is a new-generation drug. It is not a controlled substance, is not addictive, and works through histamine receptors. For many patients, it is revolutionary. The company has already received FDA approval and is expanding its indications. HRMY shares are showing resilience, and the business has positive cash flow.

Harmony is one of the few companies in the sector that is already generating stable earnings. There is growth potential, especially if Wakix receives expanded indications for obstructive sleep apnea or Parkinson’s disease.

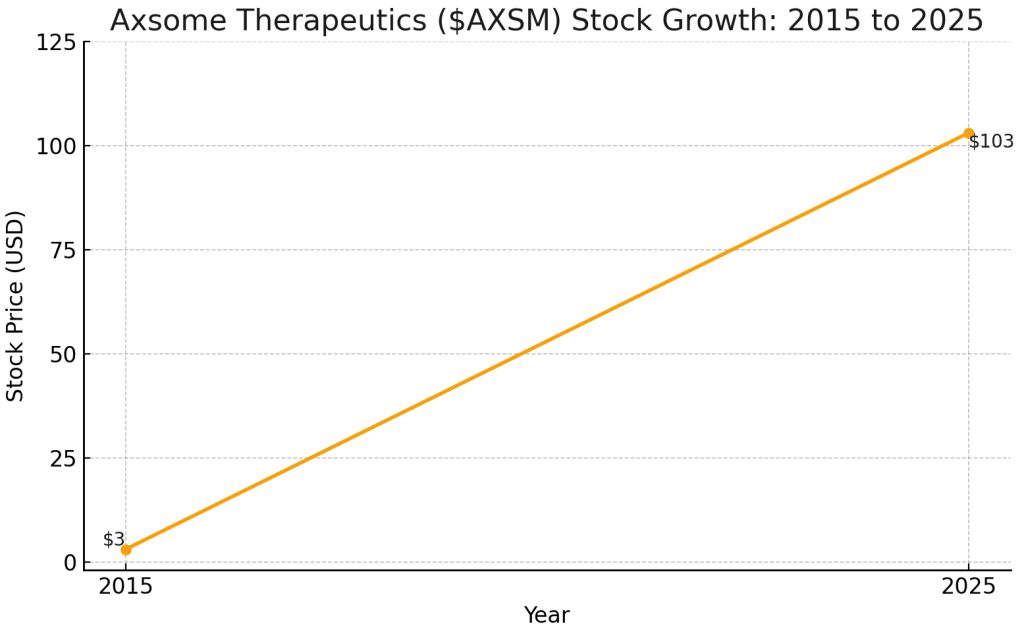

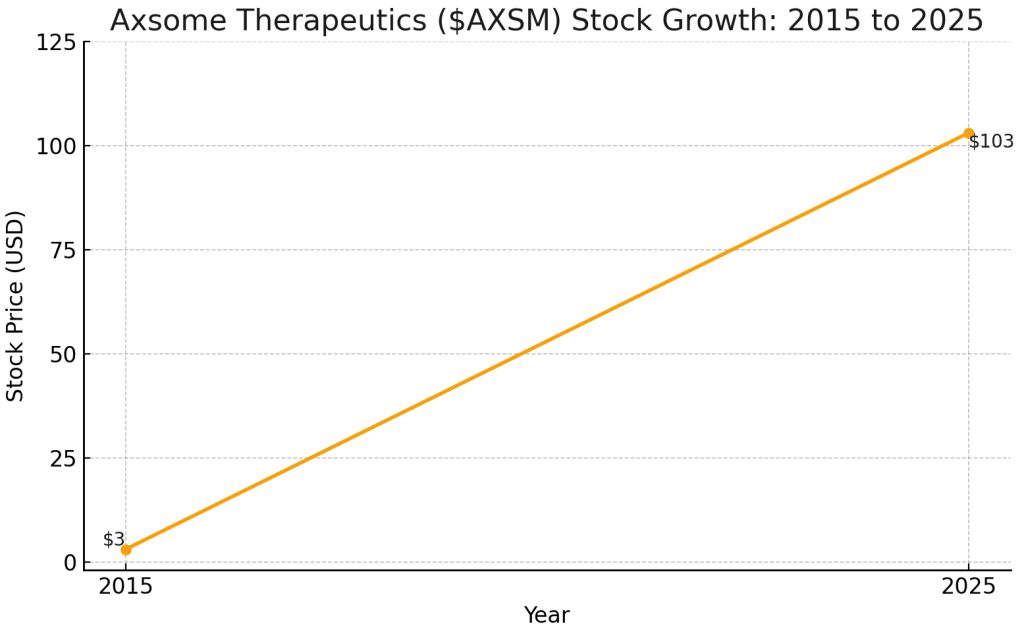

Axsome Therapeutics ($AXSM) is a growth star

If you had invested $1,000 in $AXSM ten years ago, you would have $33,000 today. From $3 to over $100, that’s a 3,300% increase. And this is not a bubble. It is the result of competent product development.

AXS-12 (reboxetine) is a flagship treatment for narcolepsy that is in the final stages of clinical trials. Investors are waiting for FDA approval to start a new chapter.

Axsome is also interesting for its portfolio: the company is working on therapies for depression, Alzheimer’s disease, and migraines. $AXSM is hardcore growth, but backed by real science and strong management.

Alkermes ($ALKS) fundamentals and long-term strategy

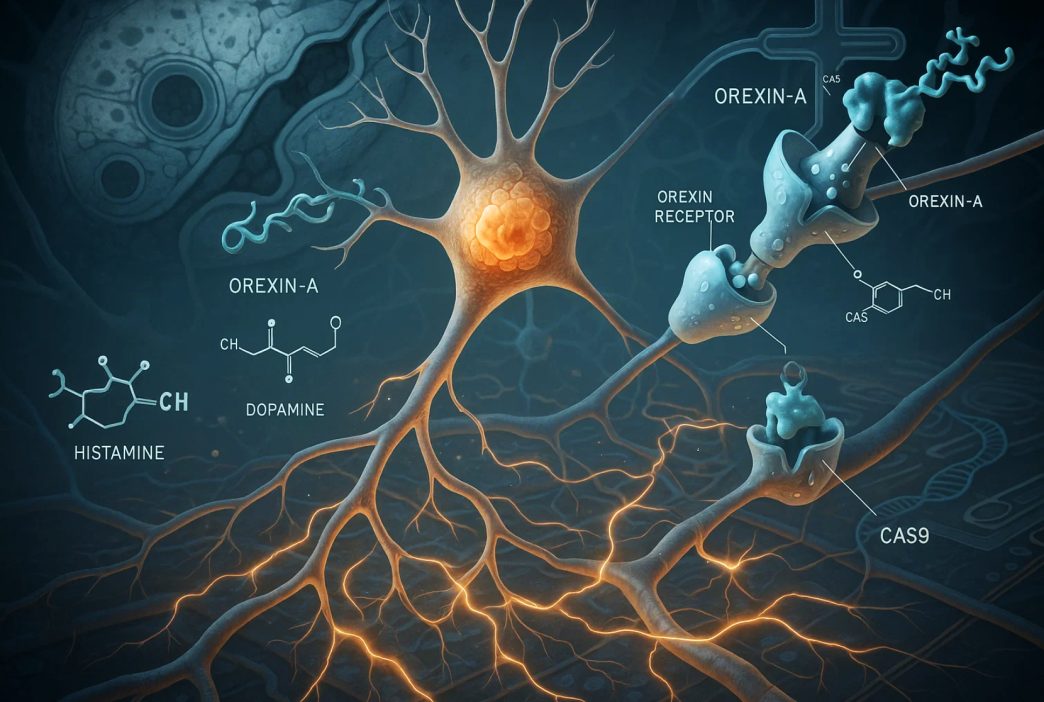

Alkermes is quietly but steadily developing a treatment for narcolepsy. ALKS 2680, their candidate, targets the orexin system, a key mechanism in sleep.

The company already has products on the market, which reduces risk. $ALKS is a long-term play, with a focus on a sustainable model and rigorous scientific validation. Institutional investors value the company for its transparency and fundamentals. Suitable for those who want exposure to the theme without excessive volatility.

Takeda ($TAK): a global giant with Japanese tenacity

Takeda is Japan’s largest pharmaceutical company and one of the most conservative players in the market. Despite the failure of TAK-994, the company continues to develop programs targeting orexin receptors.

Its huge infrastructure, global reach, and scientific capabilities make $TAK a stable long-term bet. Yes, volatility is lower. But reliability is higher. An excellent addition to a balanced portfolio if you believe in the potential of orexin drugs.

Centessa Pharmaceuticals ($CNTA) is a niche player with global ambitions

Centessa is a biotech company with a strong scientific philosophy: a focus on deep biology and targeted action. Their flagship drug, ORX750, is for treating type 1 narcolepsy and is an innovative orexin agonist.

The drug is still in the early stages, but it’s already getting attention from big funds and analysts. ORX750 is super selective for orexin receptors, which could mean it’s really effective with minimal side effects. Investors should keep an eye on the speed of patient recruitment and the first clinical results. Centessa is a long-term play, where high scientific complexity could translate into a multiplier for value. Given that the company received $80 million in funding in 2023, it has sufficient resources to move forward.

Should you buy shares in companies fighting narcolepsy?

We also recommend reading our article Tronox shares: an undervalued asset with X2 potential, which explores another interesting opportunity for investors in the commodities market.Investing in biotech focused on narcolepsy is a game of staying ahead of the curve. There is no 100% predictability here. But there is potential for multiple growth, especially for companies with innovative solutions and commercialization experience.

$JAZZ and $TAK are reliable foundations. $AXSM and $AVDL are growth rockets. $HRMY and $ALKS are balanced stories. $CNTA is a venture bet with a unique niche. Every investor has their own goals and horizon. The narcolepsy market offers enough variety for everyone.

It is important to understand that success in this segment depends not only on scientific innovation, but also on competent management, marketing, and market entry strategies. The biotech industry requires constant monitoring and flexibility. If you are willing to take risks but are looking for an area where technology is truly changing lives, narcolepsy may be the category to start with.

Are you interested in gene therapy and breakthrough biotechnologies?

Read our analytical review Genome editing and company shares: who will set the pace in the market in 2025? It examines the leading players in the field of genome editing and their investment potential.

Frequently asked questions (FAQ)

Which drugs have already been approved by the FDA?

Jazz Pharmaceuticals — Xyrem and Sunosi. Harmony Biosciences — Wakix. Avadel — Lumryz (from 2023). These drugs are commercially available and provide a steady stream of revenue for their manufacturers.

Which companies are the most promising for investment?

Axsome Therapeutics ($AXSM) with growth of over 3,300% in 10 years. Avadel ($AVDL) with its new drug Lumryz. Harmony ($HRMY) and Jazz ($JAZZ) are stable and profitable. Centessa ($CNTA) is high-risk but promising.

What makes $CNTA interesting?

ORX750 is an innovative drug for the treatment of type 1 narcolepsy. It is still in the early stages, but has a unique mechanism of action that makes the company attractive to venture capitalists and institutional investors.

Why are large funds investing in the narcolepsy sector?

High return potential, low competition, expensive drugs, and steady demand. This is one of the few niche biotech segments with this combination of factors.

Ready to invest in companies that treat narcolepsy?

Narcolepsy is not only a serious medical condition, but also a real opportunity for savvy investors. Attention to this condition is growing: demand for innovative drugs is increasing, and breakthrough technologies and regular FDA approvals are paving the way for new business models. Companies working in this field are already demonstrating strong financial metrics, and interest from institutional investors continues to grow. Today, when classic biotech is overheated, it is precisely these narrow niches that offer the chance to find dark horses with X5–X10 potential. Are you ready to bet on the health of millions and make money from it? Then now is the time to act.