Strategy and Bitcoin: how MSTR shares became an alternative to cryptocurrency ETFs

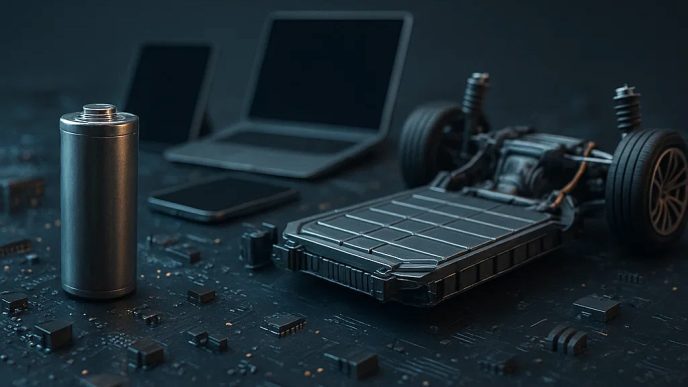

Strategy, formerly known as MicroStrategy, is originally a BI (Business Intelligence) company, i.e. a developer of analytical software that helps businesses collect, visualize and interpret large amounts of data to make decisions. In simple words, it is “smart reports” for corporations: from finance to marketing.

However, as early as 2020, the company made a sharp turnaround: by starting to buy bitcoin en masse, it practically transformed into a public “cryptocurrency” – while retaining its software platform. Today, MSTR’s stock reflects not so much the prospects of the BI business, but rather a bet on the digital gold of the new age.

Bitcoin exchange rate as a driver of capitalization

Most importantly, Strategy is not just holding BTC – it is actively accumulating it

As of July 2025, Strategy has more than 600,000 BTC on its balance sheet, making it the largest corporate holder of cryptocurrency in the world. At the current exchange rate, that’s over $70 billion in assets. For comparison, the market capitalization of the company itself is $30-35 billion. This delta creates a built-in “leverage” effect, and that is why MSTR sharesshow sharp movements in both directions at the slightest fluctuations in the crypto market.

Why are MSTR shares appreciating faster than bitcoin itself?

Unlike passive ETFs, Strategy is constantly increasing its stake in BTC by issuing new shares and debt. This allows positions to build up, creating a “multiplier” of growth. When bitcoin appreciates – the company’s net asset value grows exponentially. Investors see this and start to buy MSTR shares more actively, expecting even faster growth than that of the underlying asset. However, there is a weak link: a sharp decline in BTC leads to an avalanche-like fall in quotations, which has already happened many times against the background of corrections in 2021 and 2022.

Stock growth: $MSTR +300% in 12 months – and this is not the limit yet?

Interestingly, Strategy stock has outperformed not only bitcoin, but also ETFs on it

While BTC has added about 190% over the year, MSTR stockhas grown by 315%. This is not only due to Strategy’s active crypto strategy, but also because the company is often used by traders as a more liquid alternative to crypto exchanges – especially for institutional trades.

In addition, Strategy’s securities are part of the Nasdaq-100, which gives it a steady demand from index funds.

MSTR Stock vs. Bitcoin and Crypto ETFs

| Instrument | 12-Month Return | Volatility | BTC Correlation | Exchange Access | Risk Level |

|---|---|---|---|---|---|

| MSTR Stock | +315% | Very High | Direct, leveraged | Nasdaq | High |

| Bitcoin (BTC) | +190% | High | — | Crypto exchanges, OTC | High |

| IBIT (BlackRock) | +175% | Medium | Direct | Nasdaq | Medium |

| BITO (Futures ETF) | +160% | Medium–High | Indirect | NYSE | Medium |

Unlike traditional ETFs, MSTR stock amplifies Bitcoin’s price movements through the company’s strategic approach—accumulating BTC by issuing shares and convertible debt. This effectively turns Strategy into a “leveraged Bitcoin proxy,” offering the potential for outsized returns, but also increasing exposure to sharp corrections when the crypto market cools.

How are institutional investors reacting?

Crypto-exposure funds are increasingly including MSTR shares in their portfolios as a hybrid instrument. This allows them to comply with regulatory frameworks (since the stock is traded on Nasdaq) but still participate in the growth of BTC.

Some are using MSTRs as a hedge against inflation and as a substitute for ETFs until the market offers a full selection of spot products with sufficient liquidity.

Risks? Absolutely. But the opportunities are significant, too

What an investor entering MSTR needs to consider

- Extreme volatility. One tweet by Ilon Musk and the BTC rate can fall by 15%. For MSTR stock, that could mean -25% in a day.

- Dependence on Fed and SEC policy. Any tightening of control over the crypto market is immediately reflected in the price.

- Constant issuance. The company regularly issues new shares and convertible bonds, which dilutes shareholders’ stakes.

- Fundamental overvaluation. More than 90% of the capitalization is cryptocurrency assets. BI business plays a secondary role.

What’s wrong with the business? It still exists

MicroStrategy’s ONE platform works – but doesn’t determine share price

Strategy’s arsenal of analytics solutions remains in place, used by banks, telecom companies and retailers. The BI platform allows collecting reports, analyzing customer behavior, and making forecasts. In 2024, this area has generated about $486 million in revenue – not a small amount, but clearly not something that affects MSTR’s stock price today.

Most investors view the BI line of business as a safety net, but not as a source of growth drivers.

Will there be a separation of the business?

Recently, rumors of a possible restructuring have begun to surface. Allegedly, Strategy may separate the BI business into a separate company and keep the cryptocurrency business publicly listed. This would allow for greater transparency and more accurate valuation of each component. So far, management has officially denied this, but the market is watching closely.

Who is behind Strategy Strategy?

Michael Saylor is the architect of crypto strategy

He is considered one of bitcoin’s most consistent evangelists. Purchases of hundreds of millions worth of BTC when the exchange rate was falling, claims of a “new digital gold” and dozens of interviews with Bloomberg, CNBC and even on Joe Rogan’s podcasts have all made Saylor a recognizable figure. Though he’s no longer CEO, Saylor retains a key role as executive chairman of the board.

Who’s running the operations side of things?

Since 2022, Strategy has been led by Phong Le, an experienced CFO who comes from the banking industry. His job is to ensure the sustainability of the BI division and maintain corporate discipline in a volatile crypto market. This duo – Sailor (ideology) and Le (structure) – seems to be balanced at the moment, and this is positively perceived by the market.

Example scenario: what would an investor set on BTC growth do?

If you believe in bitcoin and expect it to grow to $150-180k in the 1-2 year horizon, MSTR stock is a way to play that growth with a multiple. It’s quite possible that Strategy securities could then double or even triple if the current rate of BTC accumulation and the market’s loyalty to erosion continues.

However, it’s worth remembering: if BTC rolls back below $80,000 – the stock could lose a third of its value in just a week. This is not a market for the faint of heart.

MSTR stock is no longer just IT, but an indicator of the digital gold era

Strategy is a unique case at the intersection of technology, finance and cryptocurrencies. It is both a technology company, an ETF analog on BTC, and a high-risk bet on the digital future. An investor should approach MSTR not as an ordinary stock, but as an instrument with a strongly directional bet. Yes, it’s a risk. But it’s also a long shot.

MSTR shares are not just a volatile asset, they are an indicator of sentiment in the entire crypto market. Their growth can significantly outpace bitcoin, but their drawdown can also be catastrophic – especially against the backdrop of increasing regulatory pressure. For investors who are not ready for high turbulence, MSTR shares may seem to be an overly aggressive instrument. However, for experienced participants looking for ultra-profitable ideas in the digital asset sector, it is one of the most expressive bets on BTC growth.

Bitcoin and MSTR shares offer exciting growth prospects, especially during crypto rallies, and a prudent investor should not limit themselves to just one asset class. The biotech sector is attracting increasing attention as an area where innovations in medicine, gene therapy, and AI diagnostics are laying the foundation for long-term growth. Diversifying your portfolio is worthwhile not only to reduce volatility but also to participate in global healthcare trends.

For more information, see our article on high-potential biotechnology stocks.

MSTR stock is actively being used as an “exchange-traded lever” for crypto exposure, especially in the face of a limited supply of spot ETFs. Interestingly, even some institutional funds have begun to include Strategy securities in portfolios as an aggressive alternative to bitcoin. It is quite possible that in the event of a new bull market cycle, MSTR stock will be the focus of a much wider audience of investors than it is today.