Clinical trials: how phases 1, 2, and 3 affect biotech stocks

Investing in biotech companies is always an investment in science, timing and uncertainty. Therefore, understanding where a company’s drug is at is a key skill for any investor.

Clinical trials determine a product’s likelihood of success, risk and potential return on investment. Each phase of research has a direct impact on the dynamics of the stock: positive results can cause the quotes to grow by tens of percent, while failures can lead to a collapse.

To properly analyze biotech stocks, it is necessary to understand the stages of trials, from preclinics to registration and market entry.

Preclinical testing: the first stage before market entry

Before a company is authorized to conduct clinical trials, it must complete the preclinical trials stage. This stage aims to test the molecule under laboratory conditions, including:

- in vitro (on cell cultures)

- in vivo (in animal models)

The aim is to study the toxicity, pharmacokinetics, metabolism and possible side effects of the drug. These data form the basis for filing an IND (Investigational New Drug) application with the FDA. Although investors rarely enter at the preclinical stage, in the case of a unique technology or breakthrough mechanism of action, a company may receive significant funding from venture capital funds or strategic partnerships. This may stimulate a stock price increase even before the start of Phase 1.

Phase 1: safety testing on the first volunteers

Phase 1 is the first stage of testing the drug on humans. The main goal is to determine safety, tolerability, and pharmacological characteristics. The study usually involves 20 to 100 healthy volunteers.

During this phase, the following are evaluated:

- side effects

- maximum tolerated dose

- absorption rate, metabolism and excretion of the drug

Investors should not expect this phase to have a significant impact on the share price unless the results show unexpected side effects, in which case quotes may fall sharply. Phase 1 is important as a foundation. If it is successful, the company gets the green light for the next phase.

Phase 2: evaluation of efficacy and treatment regimen

Phase 2 is for the initial assessment of the drug’s effectiveness and refinement of dosage. Usually several hundred patients with the target disease participate.

Phase 2 objectives:

- Evaluate the clinical effect

- select the optimal dose

- Collect additional safety data

The publication of positive Phase 2 results may trigger a surge of investor interest, as it provides the first confirmation that the drug really works. However, the risks are still high: around 30-35% of drugs do not progress beyond this stage. Examples: successful completion of phase 2 by biopharmaceutical companies like Revolution Medicines or Sage Therapeutics has often been accompanied by double-digit share growth.

Phase 3: the final stage before registration

Phase 3 is a critical stage on which a drug’s market entry depends. The study involves hundreds or even thousands of patients. The goal is to finally confirm safety and efficacy on a representative sample.

Studies are often compared to current treatments (standard of care), placebo or double-blind comparisons are used. A positive result opens the way to filing an NDA (New Drug Application) with the FDA. However, failures are also possible at this stage: if the drug fails to show clinical benefit or serious side effects are detected, the quotations may collapse.

Example: Axovant Gene Therapies stock lost more than 60% in one day after a failed Phase 3.

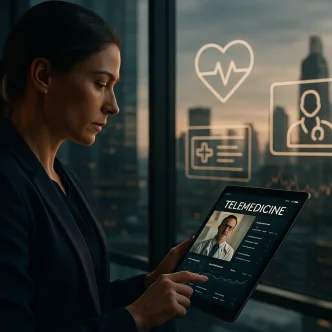

After phase 3: incorporation and going public

After successfully completing Phase 3, the company submits a complete application for approval to the FDA. The regulator analyzes clinical data, manufacturing processes, safety and packaging. If successful, the drug receives marketing authorization.

It is important for the investor to know:

- priority review is possible

- accelerated approval is available.

- FDA may request additional data

After approval, commercialization of the drug begins and the key metric is revenue, not clinical news. Some companies transfer the rights to sell to large pharma giants by entering into license agreements.

However, even after approval, there are possible risks: competing drugs, insufficient demand, or manufacturing difficulties can limit growth.

How to use knowledge of trial phases to invest

Understanding trial design allows you to:

- Properly assess risks at each stage

- find companies with significant clinical events ahead of them

- Avoid overvalued assets without real results

- Determine when to enter and exit a position

An investor should:

- Track ClinicalTrials.gov

- Read company and FDA press releases

- Analyze study design (randomization, control groups)

- Consider approval status (orphan drug, fast track, etc.)

Probability of successful progression at each stage

| Stage | Probability of advancing to the next stage |

|---|---|

| Preclinical trials | 67% |

| Phase 1 → Phase 2 | 63% |

| Phase 2 → Phase 3 | 33% |

| Phase 3 → Approval | 58% |

| Overall probability of success | ~10–14% |

One of the most notable examples of success in biotechnology is Moderna (MRNA), which has made a breakthrough with mRNA technology. Find out how its business is developing and whether it is worth investing in Moderna (NASDAQ:MRNA) shares in 2025 — a detailed review is available here.

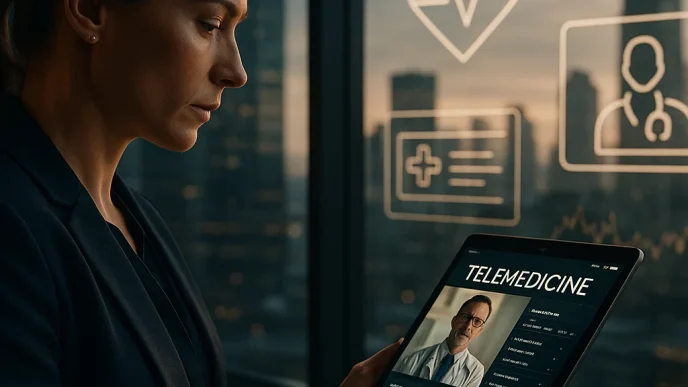

Why an investor needs to understand clinical trials

Clinical trials are the main filter through which all innovative drugs in biotechnology pass. For an investor, it is not just a formality, but a sequential chain of events, each of which affects the capitalization, institutional interest and long-term potential of the company. Understanding the structure of phases allows to recognize risks and find growth points in time. Companies that confidently pass through the phases and have a strong development portfolio can become the basis of a promising biotechnology portfolio.

Investing in biotech stocks can bring significant returns – especially if the phases of clinical development are properly assessed. The example of companies such as Moderna, BioNTech or CRISPR Therapeutics shows how successful clinical data and FDA approvals can cause quotations to rise by tens and sometimes hundreds of percent in a short period of time.

This sector is highly volatile, but that’s what makes it offer unique entry points. For patient investors willing to analyze the underlying science, track trial phases and evaluate drug potential, biotech stocks can be one of the most profitable parts of a U.S. investment portfolio.