Why future biotechnologies are becoming a major growth driver

Future biotechnology is not a fantasy, but a strategic reality for investors. The world is undergoing massive changes in healthcare, agriculture and the environment. Biotechnology is at the intersection of these transformations. They have already begun to shape new markets, which in 10 years may become the standard of living.

Investments in biotechnology show a steady growth: since 2010, investments in this sector have grown 4 times. This is explained not only by the development of technologies, but also by a shift in consumer logic – patients, agro-producers and governments expect personalized, efficient and environmentally friendly solutions.

For investors, this means the need to position themselves in advance in niches that will be dominated by new leaders in the future. In this article, an overview of the areas where growth is most likely.

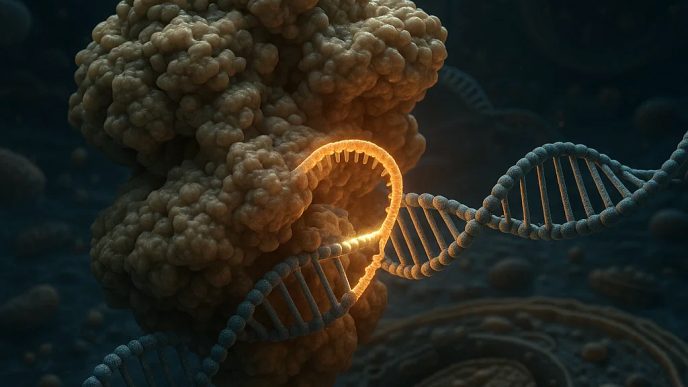

Genetic engineering and DNA editing: a new generation of therapy

In recent years, gene therapy has moved from experimental approaches to the stage of implementation. DNA editing technologies, especially those based on the CRISPR platform, make it possible to correct genetic mutations with a precision previously unavailable in medicine.

Illustrative cases include the successful treatment of sickle cell anemia, beta-thalassemia and certain forms of cancer. More than 40 startups around the world are working on the development of drugs based on genetic engineering.

Sector outlook:

- Expected size of the gene therapy market is ~$60 billion by 2032

- More than 500 active clinical trials

- Adoption of editing technologies not only in treatment but also in diagnostics

Investors should keep an eye on companies already in Phase 3 trials with strong patent portfolios. Leaders include CRISPR Therapeutics (CRSP), Intellia Therapeutics (NTLA), Beam Therapeutics (BEAM), and Editas Medicine (EDIT). Giants like Vertex Pharmaceuticals are also active, which is boosting the confidence of institutional investors in the technology.

Synthetic biologics: a trillion-dollar market

Synthetic biology is transforming not only healthcare but also industrial processes. It is the creation of new organisms and modified systems capable of performing specified functions: from synthesizing complex molecules to converting waste into energy.

The most promising directions:

- Production of alternative meat and protein

- Biological recycling of plastic and CO₂

- Creation of biomaterials for construction, textiles and packaging

Synbiotech makes it possible to “print” new life forms customized for specific tasks. This opens the way to a more sustainable, low-carbon economy.

Projected growth of synthetic biology segments by 2035

| Segment | Market size 2025 (Billion $) | Forecast 2035 (Billion $) | CAGR, % |

|---|---|---|---|

| Cultivated meat | 12 | 85 | 21.4 |

| Biofuel | 6 | 38 | 20.1 |

| Industrial biomaterials | 4 | 29 | 22.8 |

Leading companies: Ginkgo Bioworks (DNA), Amyris (AMRS), Pivot Bio, Zymergen. These firms receive funding from major investors such as SoftBank and Baillie Gifford, and actively collaborate with government agencies and international corporations.

Next-generation biopharmaceuticals: replacing conventional medicine

Medicine is shifting its focus from one-size-fits-all drugs to individualized treatments. Biopharmaceuticals play a key role in this process. Key technologies:

- Monoclonal antibodies – selectively targeting specific cells

- RNA therapy – delivering instructions to the cell to produce the desired protein

- Cell therapy – using a patient’s immune cells to fight cancer

After the pandemic, the popularity of the mRNA platform (Moderna, BioNTech) proved the speed and flexibility of the approach. The technology is now being actively used to develop vaccines against HIV, influenza, cancer and even rare genetic diseases.

Investors should pay attention to companies with ready mRNA platforms, stable supply channels and international certification. Moderna (MRNA), BioNTech (BNTX), and Arcturus Therapeutics (ARCT) are obvious examples to include in a biotech portfolio.

Biotechnology outside of medicine: agro-industry, ecology, sustainable production

Although medicine is the main driver of interest, biotechnology of the future is also actively developing in related sectors.

Agriculture

- Biogenic fertilizers and insecticides

- Genetically modified crops resistant to climate stresses

- Precision farming using sensors and AI

Ecology and sustainability

- Wastewater treatment with biomethods

- Bacteria for soil remediation

- Biofiltration of heavy metals and toxic waste

Energy

- Bio-hydrogen as a substitute for fossil sources

- Enzymatic production of fuels from cellulose

Companies in these niches tend to be smaller in capitalization but have high growth potential. They can be found in the segment of startups and small public companies focused on agro-technology and green chemistry.

Take a look at Revolution Medicines (ticker: RVMD), whose shares are traded on the Nasdaq. It is one of the brightest representatives of a new generation of biotechnology companies focusing on the development of innovative cancer treatments. Read more in a separate article about Revolution Medicines.

Where to look for growth points for investors in biotechnology

In 10 years, biotechnology of the future may enter a phase of mature growth. Investors today have a unique opportunity to get in early.

Strategic Benchmarks:

- Companies in late-stage trials

- Participants in government programs and international initiatives

- Players with global partnerships and manufacturing infrastructure

The key is to realize that in biotechnology, it’s not just ideas that matter, but real-world implementation. Therefore, when selecting stocks, pay attention to patent protection, readiness to scale, partnerships with Big Pharma and regulatory approvals. A portfolio focused on promising biotechnology is a bet on quality growth in one of the fastest growing industries of the 21st century.