Lithium – the “white gold” of the 21st century

If oil was the symbol of energy in the 20th century, lithium is gradually taking over that role in the 21st century. This metal is called the “white gold” of the new economy. It is the basis of lithium-ion batteries that power electric vehicles, smartphones, and energy storage systems for solar and wind power plants.

According to the International Energy Agency (IEA), global demand for lithium will triple by 2030 and could increase more than sevenfold by 2040. The main drivers are the rapid growth in electric vehicle sales and the introduction of energy storage technologies. For investors, this means that companies controlling strategic deposits will become the foundation of the new energy system. At the center of this process is Lithium Americas Corp. (NYSE: LAC).

Two world-class projects

The company is developing two key assets simultaneously:

- Cauchari-Olaroz (Argentina) is one of the world’s largest lithium salt deposits. A joint venture with China’s Ganfeng Lithium has already produced its first output in 2023. The first phase is designed to produce 40,000 tons of lithium per year, with the potential to double that amount.

- Thacker Pass (Nevada, USA) is North America’s largest lithium deposit with reserves of approximately 16 million tons of LCE. The first phase of the project will provide 40,000 tons of lithium carbonate annually, with the second phase doubling production.

Lithium Americas thus has a balanced portfolio: Argentina provides access to international markets, while the US is a strategic partner in ensuring the country’s energy independence.

Thacker Pass is a strategic project for the US

Today, the US is in dire need of its own lithium supplies. More than 70% of global processing and battery production is located in China, creating a risk of dependence. The White House has included lithium in its list of critical minerals necessary for national security.

Thacker Pass has become a symbol of the new policy. The US government sees it as a project of national importance, and General Motors has invested $650 million to gain access to future supplies for electric vehicles. This is the largest deal between an automaker and a mining company in history.

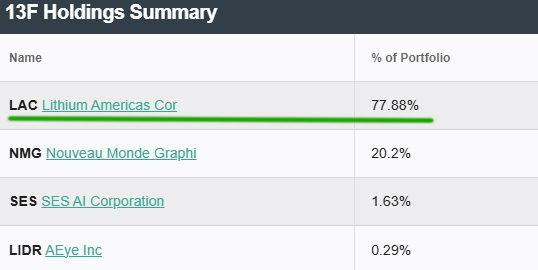

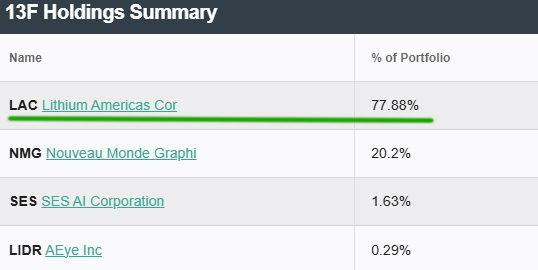

LAC shares account for more than 77% of General Motors Holdings.

In effect, Lithium Americas has become part of Washington’s strategy to reduce dependence on Chinese imports. For investors, this means that the project will develop under the protection of the state and the automotive industry.

Argentina and South America: the second center of growth

The Cauchari-Olaroz project in Argentina gives the company access to the “lithium triangle,” a region that contains more than half of the world’s reserves of the metal. Argentina actively supports investment in mining, which sets it apart from politically unstable Bolivia.

Industrial production has already started, and the project will begin generating stable cash flow for the company in the coming years. This is important: LAC is gradually transitioning from a developer to a producer.

Lithium Americas Corp investors and partners

Lithium Americas Corp. shares are held in the portfolios of major institutional investors such as BlackRock, Vanguard, and Fidelity. This confirms the interest of long-term funds betting on green energy.

A key strategic partner is General Motors, which has not only provided financing for Thacker Pass but also guaranteed demand. This alliance reduces the company’s risks and strengthens investor confidence.

Why are the shares undervalued now?

Despite its strategic importance, LAC shares are currently trading at around $2.8–3 with a market capitalization of approximately $500 million. For a company with such projects, this is an extremely low valuation.

Lithium Americas (LAC) shares are consolidating in the $2.60–3.30 range, and the market seems to be waiting for a breakthrough: support at $2.60 has held for several months, while the $3.00–3.30 zone remains the main barrier to growth. The stock is trading above its 50-day average, indicating growing buying pressure, and a break above $3.00 could trigger a move towards $3.80 and above. Given the launch of strategic projects in the US and Argentina, current levels appear undervalued — this is where the foundation for a future trend is being laid, one that could bring investors multiple gains.

Reasons for undervaluation:

- the market still perceives LAC as a “developer,” even though production has already started,

- the correction in lithium prices has temporarily cooled interest in the sector,

- revenues from Thacker Pass and Cauchari-Olaroz are not yet reflected in financial results.

Once production reaches design capacity, the company’s market capitalization could increase several times over.

Why invest in LAC right now

- Low entry point. The stock fell after the correction in the lithium market, and this is a chance to enter at minimum levels.

- Transition phase. The company is transforming from a developer to a producer, and the market will soon revise its valuation.

- Government priority. Support from the US government reduces regulatory risks and opens up financing opportunities.

- Guaranteed demand. General Motors’ investment confirms that LAC’s lithium is already “booked” by the largest automaker.

- Global trend. Electric vehicles and energy storage will grow for decades, and lithium will remain a key resource.

Conclusion: betting on the future of energy

For investors focused solely on growth, Lithium Americas shares appear to be an attractive asset with significant upside potential. However, the lithium market is highly volatile, and not all companies are able to withstand price downturns. That is why some traders use reverse strategies, betting on a decline in securities during periods of correction. We discussed how this tactic works and when it can be used in more detail in our article How to short a stock and profit from its decline.

LAC shares are an excellent choice for serious investors, not speculators

Lithium Americas Corp. shares are not just an investment in a single company. They are a bet on the future of global energy, where lithium will play the same role that oil played in the 20th century.

The market is still underestimating the scale of LAC’s projects, but strategic support from the US, the involvement of General Motors, and the launch of production in Argentina are turning the company into one of the key players in the industry. Buying LAC shares now means taking advantage of a moment when the price does not yet reflect the company’s strategic importance. For investors who believe in the electric vehicle revolution and the energy transition, this is a rare opportunity to enter an asset with the potential for multiple growth.