What is short selling and how to profit from falling prices

Buy low, sell high — every investor is familiar with this idea. But not everyone plays this way on Wall Street. There are those who prefer to short a stock, i.e., bet on its decline. This strategy is for those who know how to analyze, question, and act ahead of the curve.

Let’s take a look at how to short a stock in practice, who does it, why, and why this strategy is not about fear, but about calculation. Want to see the other side of the market?

What is shorting and how does it work?

On the surface, it looks simple. You borrow shares from a broker, sell them, and then, if you’re lucky, buy them back at a lower price. The difference is your profit. But in reality, it’s not that straightforward. What if the price goes up? What if you can’t find the securities to close your position? Every step is like walking on thin ice.

Shorting stocks is a strategy in which you profit from revaluation. Not potential revaluation, but a market illusion that you are prepared to destroy. You believe that the price is unfairly high and are willing to bet on it falling. This is not just a transaction, but a challenge to the consensus. Let’s take an analogy: in classic investing, you buy a company as if you were a partner. When you short, you are against it. You look deep: reports, liabilities, news between the lines. You look for inconsistencies. It’s more like an investigation than a deal. History knows many examples when short sellers were the first to notice a hole in the reporting or fiction in the figures. Enron, Wirecard, Luckin Coffee — if it weren’t for short selling, the world might have learned the truth too late.

But don’t forget that shorting stocks is not just analysis, it’s also a huge responsibility. You are obligated to return the asset, which means that any movement against you becomes a threat. That’s why shorting requires not only calculation, but also inner composure.

Why investors decide to short a stock: motives and logic

1. Stocks are overheated and the bubble will burst

Securities regularly appear on the market that grow not because of, but in spite of everything. Financial indicators are weak, prospects are vague, but the price creeps upward. Why? Sometimes because of media hype, sometimes because of meme culture, sometimes because “everyone else is doing it.”

Short sellers see this as a weak link. Where the crowd dreams, they bet on a sobering reality.

Example Nikola (NASDAQ:NKLA)

In 2020, a startup with no product was trading like a future auto giant. But there was no substance behind the shiny packaging. After a report by Hindenburg Research, the market woke up with a jolt. Market cap down 75%. Short sellers are way in the black.

2. Capital protection: hedging through shorting

Not every short is aggressive; often it is defensive. Imagine you have invested in strong stocks but are waiting for a market correction. What should you do? Hedge. Short the index or a competitor. That way, even if the market goes down, you maintain balance. A short position is like insurance for you. You may not need it, but when you do, it saves you.

3. Strategy against weakness

A short position can be a research tool. An analyst sees inconsistencies, imbalances, or simply oddities in financial statements or senior management behavior. He doesn’t try to shout about it in the market — he opens a short position. This is not a gesture of despair, but a way of expressing an opinion — with money.

Example Wirecard (2020)

For years, the company was praised and its shares rose. But short sellers saw that the numbers didn’t add up. In 2020, everything came to light. €1.9 billion simply did not exist. The company is completely bankrupt. Who was right? Those who were not afraid to bet against it.

How to short a stock in practice

The idea of short selling is not complicated in itself. But its implementation requires precision.

First step. Open a margin account. This is not just registration. It is a contract with a broker where you agree to return the asset you borrowed. And for this, you risk your collateral. Shorting without margin is impossible.Second. Availability of company securities. Not all stocks can be easily shorted. There are securities with limited free float, or those that have already been snapped up by other traders. Finding something to trade is half the battle.

Then there is the order itself. You sell, which means you hope to buy back cheaper. But what if the stock starts to rise? You will have to buy at a higher price, locking in a loss. That is why shorting is not a gut decision or a bet at a casino. It is a strategy with control at every stage.

Risks of short selling

There is no lower limit on profits from shorting, but there is also no upper limit on losses. And that’s not a metaphor. It’s reality.

Unlimited losses

When you buy a stock, you lose a maximum of 100%. But when you short it? If the stock skyrockets fivefold, you lose everything and more. It happens. Not often, but it hurts.

Example: Tesla (NASDAQ:TSLA)

Many considered the company overvalued. They bet on a decline. The result? Elon Musk set records, and the market believed in him. Those who shorted at $300 watched the price rise to $1,200. Tears, margin calls, closed positions.

Short squeeze: when the crowd is against you

A short squeeze is a situation where stocks with a large number of open short positions begin to rise rapidly. The reason? Not so much fundamental news as an avalanche of demand. Short sellers, seeing the rise, begin to close their positions en masse, buying back shares to limit their losses. This buyback, in turn, drives the price even higher. The result is a domino effect.This can happen spontaneously or in an organized manner. Often through forums, Reddit, and social media.

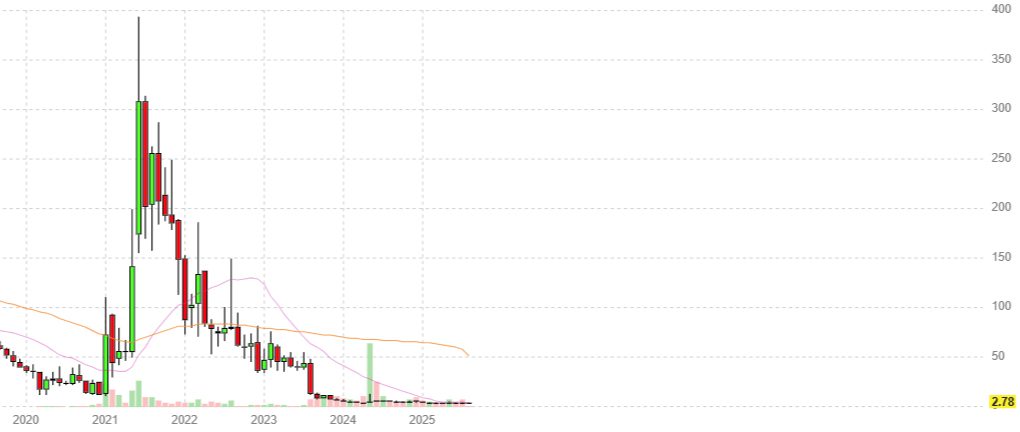

Example: GameStop (NYSE:GME)

In 2021, Reddit started a real revolution. Investors from the r/WallStreetBets community began buying GameStop shares en masse, leading to a historic squeeze. The price skyrocketed from $20 to over $400 in a matter of weeks. Hedge funds holding millions of short positions lost billions. Some were forced to close.

Example AMC Entertainment (NYSE:AMC)

A cinema chain with a loss-making model suddenly became the darling of retail investors. The share price skyrocketed by more than 1,000%, triggering a massive squeeze. Although the business remained weak, the market followed the wave of interest.

Example Carvana (NYSE:CVNA)

In 2023, shares in a used car sales company soared more than 800% in a matter of months. The reason was an aggressive squeeze: high short float, falling interest rates, improved reporting, and “fear of missing out.”

Example Beyond Meat (NASDAQ:BYND)

Despite falling sales, Beyond Meat’s shares experienced sharp price jumps due to high short levels. Any positive news, even minor, triggered a squeeze.

A short squeeze is a vivid, unpredictable, and destructive phenomenon for those who find themselves in its path. That is why shorting requires not only calculation but also constant monitoring of positions. In 2021, Reddit started a revolution. The crowd pounced on short funds. The price of GME skyrocketed. Small traders were on the rise. Large funds were at rock bottom. No one expected such a scenario. But the market is like a living organism, breathing and evolving.

The world of investment is full of unconventional players — those who rely on their convictions rather than public opinion. One such player is Michael Saylor, co-founder of MicroStrategy. He bet everything on Bitcoin, despite skepticism from Wall Street. Why he did it, what the risks were, and what the outcome was, we discuss in a separate article: Michael Saylor the Bitcoin fundamentalist who bet everything on one card.

The psychology of a short seller: going against the crowd

Shorting stocks isn’t just a strategy, it’s the ability to withstand pressure, doubt where others believe, and act when the majority dismisses.

In the world of short selling, there are no guarantees. There are only hypotheses, facts, and risks. And everything is against you. Public opinion, the media, even the market at a given moment. Being a short seller means living in counter-discourse.

But it is precisely these people who often see cracks before anyone else. They don’t wait for a signal from above. They look where others are too lazy to look. And yes, sometimes they are wrong. But when they are right, the whole market changes its opinion.

What will be shorted in 2025: bets on overheated expectations

Today, it’s not just companies that are being shorted. Narratives are being shorted. Illusions. Overrated dreams.

The AI sector. Companies like C3.ai (AI), BigBear.ai (BBAI), and SoundHound (SOUN) all promise a revolution. But where is the revenue? Where is the sustainability? Short interest is above 20%.

Electric vehicles. Lucid, Rivian, Fisker are eagerly awaited by every other investor. But there are losses, delivery delays, and debts. Funds are reacting and shorting.

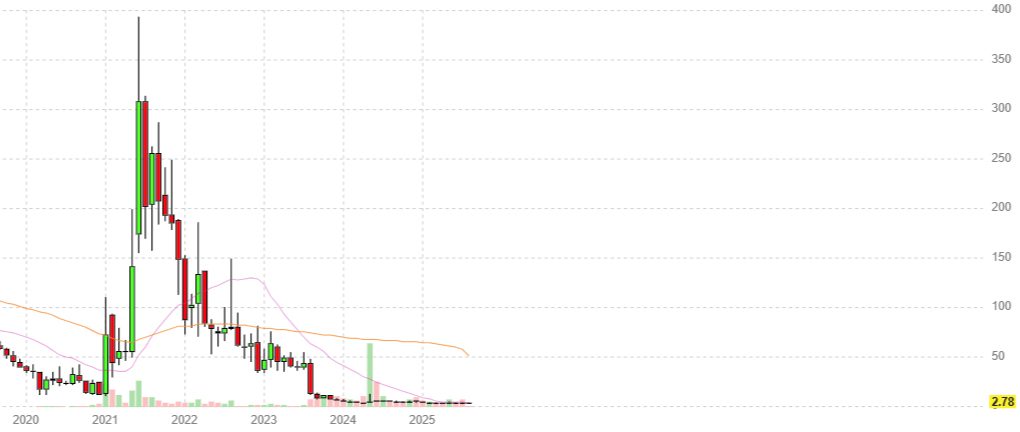

Fintech and biotech. Startups with no revenue, SPAC companies, promising platforms with a single clinical candidate. All of these are excellent targets for opening short positions.

History repeats itself, but not always predictably

A short squeeze is not a new invention. One of the most famous examples is the 1929 stock market crash. What triggered the stock market disaster? And what lessons are we still ignoring?

What investors need to know before shorting a stock

First, this is not the opposite of going long. The rules are different here. Shorting requires discipline, cold calculation, and a willingness to be wrong for a long time.

Second, the risk is unlimited. The price may skyrocket not because of fundamentals, but because of crowd sentiment. Charts don’t work against chaos.Third. Short interest. Even if you are not shorting, keep an eye on this indicator. It says more than it seems.

And finally: don’t short out of emotion. Don’t do it out of resentment toward the market. Don’t do it because something is “too expensive.” Shorting is a precise calculation, not an instinct.

Short selling is a special part of the ecosystem. It scares newbies, annoys management, and… makes the market more honest.