ALS treatment: where to invest? Overview of IONS, BIIB, CLNN, and AMLX stocks

Amyotrophic lateral sclerosis, known internationally as ALS, is a serious progressive disease that affects the neurons of the central nervous system. The disease attacks muscle control, gradually robbing a person of their ability to move, speak, swallow, and eventually breathe. At the same time, thinking and consciousness remain intact until the very end, making the disease particularly cruel.

Medicine does not yet have a cure or a way to reverse the disease. However, companies are emerging that are poised to change the game. These companies are already listed on the stock markets, opening up new opportunities for investors.

What modern science offers

From symptomatic therapy to personalized treatment

For decades, the main treatment for amyotrophic lateral sclerosis was a drug called riluzole, which can slow the progression of the disease. Later, another drug, edaravone, was added to the arsenal of doctors. It acts as an antioxidant, protecting neurons from destruction. However, both of these drugs only slightly prolong life without affecting the mechanism of the disease itself.

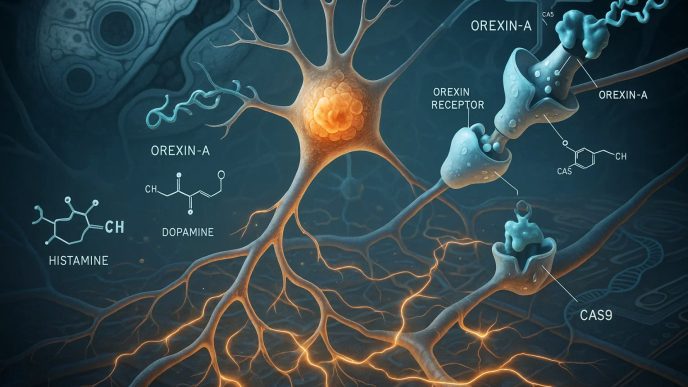

Today, biotechnology is taking a step further. Scientists are working with genes, developing targeted drugs that act on specific mutations, and experimenting with nanotechnologies that enhance the protective functions of cells. This is where the future of ALS treatment lies, as well as investment opportunities that go far beyond traditional pharmaceutical projects.

Companies developing ALS drugs and their stock market performance

Ionis Pharmaceuticals (NASDAQ: IONS) is one of the leaders in molecular therapy

The American company Ionis Pharmaceuticals (ticker IONS) has been at the forefront of the development of antisense therapies for many years. Its approach is based on blocking the synthesis of pathological proteins that cause neurodegenerative processes.

One of its major achievements was the development of Tofersen, a drug designed to treat a rare form of ALS associated with a mutation in the SOD1 gene. In 2023, this drug was approved by the US Food and Drug Administration, and in 2024, it received conditional approval for sale in European Union countries.

The company’s financial results for the second quarter of 2025 exceeded analysts’ expectations. Revenue was $452 million, with net income of 86 cents per share. The company’s shares have risen more than 24 percent since the beginning of the year, outperforming the average performance of the biotechnology sector in the United States. Analysts view IONS as a stable asset with scientific stability and a diversified product portfolio.

Biogen (NASDAQ: BIIB) is a pharmaceutical heavyweight with a focus on neuroscience

Biogen (ticker BIIB) remains one of the key players in the treatment of neurodegenerative diseases. The company is a partner of Ionis in the Tofersen project and manufactures a drug under the brand name Qalsody. However, not all of Biogen’s ventures in the field of ALS have been successful. Several programs, including BIIB078 and BIIB105, were discontinued after inconclusive clinical data.

Nevertheless, BIIB shares remain attractive to institutional investors due to their high liquidity and diverse portfolio, which includes drugs for Alzheimer’s disease, multiple sclerosis, and other conditions. This is a company chosen by those seeking reliability and risk reduction.

Clene Inc. (NASDAQ: CLNN) – boldness at the frontier of science and technology

Utah-based American biotechnology company Clene Inc. (ticker CLNN) offers one of the most unusual approaches to the treatment of amyotrophic lateral sclerosis. Its drug CNM-Au8 is based on the use of gold nanoparticles, which, according to preliminary research, can restore mitochondrial function and reduce inflammation.

The company has already begun consultations with the US Food and Drug Administration, and a decisive meeting with the regulator is expected in the third quarter of 2025. Analysts at investment bank H.C. Wainwright believe that if the outcome is positive, CLNN shares could rise several times over. Their target valuation is between $20 and $33, which is several times higher than the company’s current share price.

Amylyx Pharmaceuticals (NASDAQ: AMLX) gets a second wind

Amylyx Pharmaceuticals (ticker AMLX) entered the market with resounding success, receiving approval for its drug Relyvrio in 2022. The drug promised to be a breakthrough in the treatment of ALS. However, in 2024, the company announced the withdrawal of the product after the failure of phase III clinical trials. For most, this meant the end of the story.

Nevertheless, in June 2025, Amylyx returned with a new project. The drug AMX0114 received fast-track status from US regulators and is aimed at suppressing the enzyme calpain-2, which is involved in the destruction of neurons. Clinical trials have already begun, and the first results are expected by the end of this year. The company is betting on reviving its image and restoring investor confidence.

Investment strategy in the ALS treatment segment

The biotech sector related to ALS is a high-risk area. There are no stable dividends, and each clinical trial can either catapult the stock price upward or cause a collapse in market capitalization. However, it is precisely in such conditions that the most remarkable investment stories are born.

Ionis Pharmaceuticals (IONS) is seen as an asset with steady growth and a well-thought-out scientific strategy. Biogen (BIIB) remains the choice for those who prefer reliable stocks with minimal volatility. Shares in Clene (CLNN) and Amylyx (AMLX) are suitable for investors focused on high potential returns and willing to take risks in anticipation of scientific success.

Uranium and biotechnology: what do these two sectors have in common?

At first glance, there seems to be nothing in common between investments in uranium and drugs for amyotrophic lateral sclerosis. However, both areas have important similarities. They depend on regulatory decisions, are influenced by global political and economic factors, and in both cases, events can radically change the value of an asset in a matter of days.

Investors building aggressive or balanced portfolios are increasingly combining high-tech biomedical companies with resource assets, including uranium stocks, as part of their strategy to protect against macroeconomic risks.

Top 5 US uranium mining stocks for investment.

ALS treatment: scientific progress as an investment opportunity

Amyotrophic lateral sclerosis remains one of the most challenging diseases facing modern medicine. However, companies working in this field are not just fighting the disease. They are shaping a new market where medical science is becoming a growth point for capital.

Biogen (BIIB), Ionis Pharmaceuticals (IONS), Clene (CLNN), Amylyx Pharmaceuticals (AMLX) — each of these companies is following its own path. Some already have commercially available drugs, while others are taking their first steps in clinical trials. It is important for investors to not only understand what stage each company is at, but also to be able to assess the scientific, regulatory, and market risks. Investing in ALS treatment is your bet on the future. And, as is often the case in biotechnology, that future may arrive unexpectedly quickly.

If you are interested in undervalued assets with high upside potential, take a look at our research on titanium producer Tronox (NYSE: TROX). For more details, see the article: Tronox shares: an undervalued asset with X2 potential.