Tronox Holdings: undervalued stocks with growth potential in 2026

Today, TROX shares are trading at around $3.30. The market capitalization is less than $600 million. How does this compare to assets valued at billions of dollars? It looks like the definition of a classic value investment.

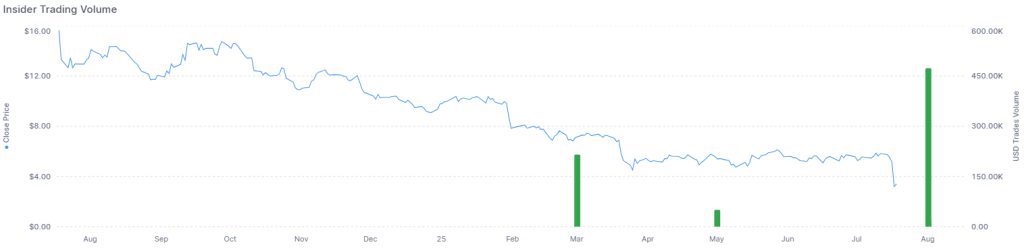

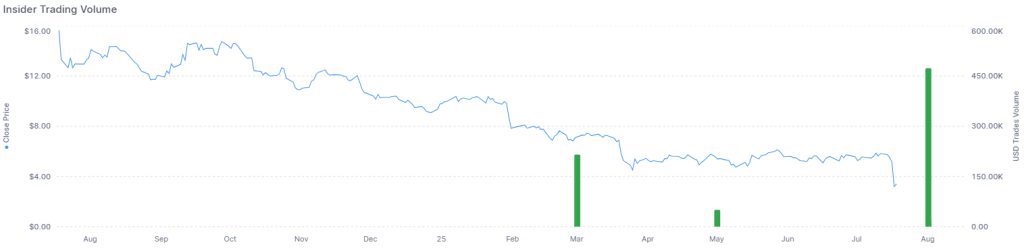

Dividends are currently suspended, but this is a temporary measure that management considers reversible. It is important to note that in July 2025, the company’s CEO purchased Tronox shares on the open market. This is a strong signal — the leader is voting with his money, not his words. Such a move increases investor confidence and can be seen as confirmation that the current price is undervalued. Management has openly stated that once the market stabilizes, payments will resume. What if TiO₂ prices rise by at least 15%? Then a doubling of the share price would be a realistic scenario. Another important point is that company insiders, including top management and board members, hold 26.40% of all shares. Such a high level of ownership indicates strong commitment and personal responsibility for the future of the business. This is a positive factor that enhances TROX’s investment attractiveness.

Where Tronox products are used

Titanium dioxide (TiO₂)

Here are just a few of the areas where TiO₂ is used:

- Construction paints and coatings, from building facades to bridges;

- Plastics, packaging, pipes, and cables;

- Cosmetics, including sunscreens and decorative products;

- Automotive enamels and paint systems;

- Toothpaste, soap, and other household products.

Zircon

Zirconium is used in more specialized areas:

- Nuclear energy, for example in the production of fuel elements;

- High-temperature refractories for metallurgy;

- Ceramics used in dentistry and orthopedics;

- Components needed for the aerospace and defense industries.

This is not just chemistry. It is the foundation of the entire infrastructure that sustains the modern world.

When could Tronox shares rise?

TiO₂ price forecast

TiO₂ prices are currently hovering around $2,900–3,050 per ton. This is practically the break-even point for the company. What if the price rises above $3,100–3,200? Then Tronox will return to stable profitability.

This scenario is realistic. Demand in the construction industry, global economic growth, and the normalization of logistics could all be triggers. And if TiO₂ rises to $3,400 or higher, TROX shares could reach $7–8 or even exceed these levels.

Technical analysis: the chart repeats the cycle

The Tronox stock chart for the past 10 years shows a clear cyclical pattern. In 2016 and 2020, the stock reached similar lows — and both times this became a point of reversal, followed by a 3-5x increase. Today’s level ($3.40) almost exactly matches these historical entry points.

Additional positive signals:

- Increased trading volumes (up to 13.46 million shares);

- Price consolidation near the bottom;

- Signs of accumulation by institutional investors.

If history repeats itself, the current level could become the starting point for a new medium-term growth. And against the backdrop of a possible recovery in the commodity cycle, this makes TROX shares particularly interesting.

Is it worth buying Tronox shares?

Why Tronox deserves investor attention

Conclusion for investors

Below are additional advantages of the company that may be important for long-term investors:

1. Long-term contracts

Tronox works with major customers in Europe, the US, and Asia, ranging from paint manufacturers to automotive component manufacturers. These partnerships create stable demand and protect the company from market volatility.

2. Global presence and market diversification

The company supplies products to more than 100 countries. This ensures broad coverage, reduces country risks, and creates a stable export revenue stream.

3. Technological leadership in the industry

Tronox uses both chloride and sulfate processes to produce TiO₂, which allows it to adapt flexibly to market conditions and make the most efficient use of raw materials. This reduces costs and maintains competitiveness even in a declining market. Potential investors want concrete data. At the end of the second quarter of 2025, Tronox had production assets in more than 30 countries and employed approximately 6,500 people worldwide. The company has long-term contracts with major customers in Europe, the US, and Asia, including manufacturers of paint and coatings, automotive components, and medical packaging.

In addition, Tronox has access to low-cost raw materials through its own production, which creates a sustainable competitive advantage. The debt-to-EBITDA ratio is under control, and in 2025, the company carried out a restructuring of part of its debt, extending maturities and reducing interest rates.

Tronox is one of the most undervalued companies in the raw materials market. Its share price reflects the current weakness of the sector but completely ignores the potential on the horizon for 2026.

The company has everything it needs to take advantage of the cycle reversal: production capacity, global logistics, crisis management experience, and highly engaged management. This is a strong foundation that is not easy to replicate.If TiO₂ prices begin to recover in the coming quarters, Tronox is capable of rapidly increasing its revenue and profits. Moreover, the strategic importance of its products makes the company a candidate for revaluation in the portfolios of large investors.

Analysts are already starting to look at TROX as an ideal value play for next year. In a cyclical recovery, it is precisely these stocks that can demonstrate multiple growth in the commodity market. Its share price reflects the current weakness of the sector but does not take into account the potential on the horizon for 2026. The company has everything it needs to take advantage of the cycle reversal: production capacity, global logistics, crisis management experience, and highly engaged management.

If TiO₂ prices begin to recover in the coming quarters, Tronox is capable of rapidly increasing its revenue and profits. Moreover, the strategic importance of its products makes the company a candidate for revaluation in the portfolios of large investors. Analysts are already beginning to pay attention to TROX as an ideal value play for next year. TROX’s share price reflects the current weakness of the sector but completely ignores the potential on the horizon for 2026. The company has everything it needs to take advantage of the cycle reversal: production capacity, global logistics, crisis management experience, and strong management involvement.

If TiO₂ prices begin to recover in the coming quarters, Tronox is capable of rapidly increasing its revenue and profits. Moreover, the strategic importance of its products makes the company a candidate for revaluation in the portfolios of large investors. Analysts are already beginning to look at TROX as an ideal value play for next year.TROX shares are a bet on a reversal in the commodities market. Yes, they are not in the spotlight right now. But it is precisely these stocks that most often show the greatest growth when the cycle turns.

Should you invest in them today? It all depends on your strategy. If you are willing to wait 12-18 months and believe in the recovery of the global economy, TROX could be the stock that pleasantly surprises you.

AST SpaceMobile: Q1 2025 Financial Results and Growth Strategies for the Coming Years.

Conclusion

Tronox is not about big headlines, but about fundamentals. The company produces key materials that are essential to the stability and growth of many industries, from construction and automotive to nuclear energy.

Amid volatility in the commodities sector, Tronox offers a remarkable combination of a vertically integrated model, global reach, and technological flexibility. This allows it to weather downturns and maintain its position even during periods of market pressure.Recent insider share purchases and the CEO’s confidence confirm that management not only believes in the future, but is also prepared to bet on it. And the high share ownership among top management is an additional incentive to act in the interests of shareholders.

2026 could be a turning point. If the TiO₂ price cycle reverses, Tronox will be among the beneficiaries. The fair value of the shares could be several times higher than the current price once the market normalizes. Buying TROX shares today is not short-term speculation, but a conscious strategic decision. In times of market turbulence, it is precisely such ideas — with real assets, high insider ownership and potential on the horizon in 12–24 months — that can deliver the best returns.

If you are looking for an undervalued stock with strong fundamentals and a good entry point, Tronox definitely deserves a place in your investment portfolio.

Read: Top 5 US uranium mining stocks for investment