Why is gene technology becoming a new investment driver?

In 2025, genome editing went from being a scientific experiment to a powerful driver of the biotech market. After the first CRISPR drugs got approved, investors saw this field as more than just a trend, but a whole new asset class with growth potential for years to come. Genome editing and the shares of companies leading the race are attracting the interest of large funds and private investors.

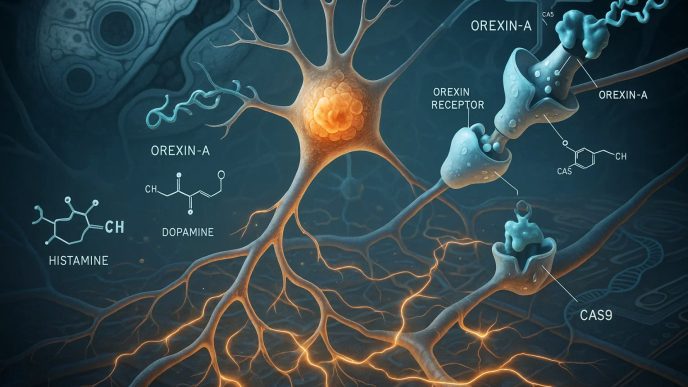

Entire groups of issuers specializing in CRISPR/Cas9, base editing, and prime editing have appeared on US stock exchanges. And although competition in biotech is fiercer than ever, it is this segment that has the potential to revolutionize pharmaceuticals by offering patients one-time and often radically effective treatments.

CRISPR Therapeutics (CRSP): from the lab to the first approvals

CRISPR Therapeutics is not just a startup, but the first company to bring the idea of genome editing to a real drug. Their drug exa-cel (Casgevy), developed in collaboration with Vertex Pharmaceuticals, is a breakthrough for the treatment of sickle cell anemia and beta thalassemia. For the industry, it was a signal that CRISPR was ready to move beyond scientific journals and laboratories.

Financially, CRSP is on solid footing — $1.2 billion in the bank and a share of exa-cel sales give the company some breathing room for new projects. Right now, it’s focused on cancer programs, including allogeneic CAR-T therapies, which use genome editing to “reprogram” immune cells.

Why CRSP shares are interesting: one of the few biotech companies with an already approved product. However, dependence on a single flagship project makes the stock volatile.

Intellia Therapeutics (NTLA): betting on in vivo editing

Intellia Therapeutics has gone further than its competitors by demonstrating genome editing directly inside the body. Their NTLA-2001 therapy has shown that a single infusion is sufficient to significantly reduce transthyretin levels in patients with ATTR amyloidosis. This is a historic achievement.

The company is actively expanding its portfolio with NTLA-2002 in development for the treatment of angioedema, as well as projects in the areas of immune diseases and liver disorders. A partnership with Regeneron strengthens NTLA’s position by providing both funding and scientific expertise.

Investment outlook: With a market capitalization of approximately $3.5 billion and several parallel clinical programs, NTLA is attractive to long-term investors willing to tolerate technological risks.

Beam Therapeutics (BEAM): a new level of precision — base editing

Beam Therapeutics stands apart with its approach to base editing, a technology that allows the “letters” of DNA to be changed without breaking the chain. This reduces the risk of side effects and increases the accuracy of treatment.

The company focuses on blood and liver diseases. The BEAM-101 program aims to modify hemoglobin, which could potentially become an alternative to expensive trans . Beam is actively collaborating with Apellis and Verve Therapeutics to develop areas with significant commercial potential.

Financial stability: With $970 million in cash, a significant patent portfolio, and a strong scientific base, BEAM is a company with long-term growth potential, although it is still a long way from final clinical trials.

Verve Therapeutics (VERV): gene therapy for cardiovascular disease

While most CRISPR companies focus on rare diseases, Verve has chosen a mass market: cholesterol reduction. The drug VERVE-101 edits the PCSK9 gene, which is responsible for lipoprotein levels. The potential here is enormous: a single injection could replace a lifetime of statins.

In 2024, Verve began clinical trials in the US and UK. Support from Beam Therapeutics and Vertex Pharmaceuticals strengthens the company’s position at the start.

For investors: if the program proves successful, VERV could become the first biotech company to offer gene-editing treatment for millions of patients — a market estimated to be worth more than $15 billion.

Editas Medicine (EDIT): strategy relaunch and new challenges

Editas was among the CRISPR pioneers, but recent years have been difficult for the company. The EDIT-101 program for the treatment of hereditary blindness is stalling in the early stages, and competition is growing. The company has announced a portfolio restructuring and is betting on oncology and Cas12a technology, hoping for a new breakthrough.

Investment risk: EDIT shares are a choice for aggressive strategies. There is growth potential, but the company is heavily dependent on the success of 1-2 projects.

Risks and competition: how to protect capital?

Genome editing remains a field of experimentation, where successes alternate with failures. Competition is not only between CRISPR players, but also from other platforms: RNAi, epigenetic modifications, viral vectors. Major pharmaceutical giants such as Pfizer and Roche are actively investing in their own developments, putting pressure on smaller companies.

Investing through ETFs: ARKG, XBI, and IBB

Not all investors are ready to pick individual stocks. In this case, funds such as ARKG (ARK Genomic Revolution ETF), which includes CRSP, NTLA, BEAM, and VERV, come to the rescue. For broader exposure, XBI (SPDR S&P Biotech ETF) and IBB (iShares Biotechnology ETF) are suitable. These funds allow you to diversify your risks and participate in the sector’s growth.

We recommend reading the article CRISPR and biotech equity investments as a new growth vector to better understand the prospects for genetic technologies and their impact on the capital market.

Genome editing and company shares as an investment choice

The genome editing sector is both highly volatile and has enormous potential. Genome editing and stocks of companies such as CRSP and NTLA have already proven that the technology works, and Beam and Verve could be the next stars of the sector. It is important for investors to diversify their risks and follow news about clinical trials.

These stocks are usually not suitable for short-term speculation — here, those who think 3-7 years ahead will win. Gene technology is developing in leaps and bounds: the testing phase, publication of data, partnerships, or approvals can radically change capitalization in a matter of days. At the same time, the failure of one key study can cause the price to plummet by 30-50%. Therefore, experienced investors use a portfolio approach, combining direct stock purchases with positions in thematic ETFs. Those looking for early-stage technology growth are betting on Beam or Intellia, while CRISPR Therapeutics is already suitable for a moderately conservative portfolio with real sales.

Genome editing is not just biotechnology, it is a philosophy of treatment where disease is eliminated at its root, at the DNA level. This means that investing in this sector is not only a bet on profits, but also on the transformation of medicine as a whole in the coming decades.